Statement of Jitse Groen, CEO of Takeaway.com: “Half-way through this transformational year, our company already looks fundamentally different from last year. Acquisitions as well as the organic development of our business contributed to the strong growth, and we have now also reached operational profitability. As the penetration of online food delivery in our Leading Markets is still low, Takeaway.com will continue to prioritise sustainable growth over profit.”

● Takeaway.com processed 71 million orders in the first six months of 2019, representing an order growth of 70% compared with the first half of 2018.

● Gross revenue1 grew by 68% to €185 million in the first six months of 2019 compared with €110 million in the first half of 2018.

● In the first six months of 2019, order growth in the Netherlands was 18%, resulting in a revenue increase of 24% compared with the first half of 2018. Adjusted EBITDA2 in the Netherlands further increased to €29 million in the first six months of 2019 compared with over €25 million in the first half of 2018.

● In Germany, Takeaway.com achieved 111% gross revenue¹ growth and 85% order growth in the first half of 2019 supported by the consolidation of the German Delivery Hero businesses as per 1 April 2019. The underpenetrated online food delivery market in Germany remains a significant growth opportunity for Takeaway.com.

● Gross revenue¹ in Other Leading Markets grew by 82% to €44 million in the first six months of 2019 compared with €24 million in the first half of 2018. Orders in Other Leading Markets showed strong growth of 123% in the first six months of 2019 compared with the first half of 2018, primarily driven by the addition of our business in Israel, which was acquired in September 2018. Excluding Israel, order growth in Other Leading Markets was 47% in the first six months of 2019 compared with the first half of 2018.

● Adjusted EBITDA2,3 for the Company was €1.8 million in the first six months of 2019 compared with minus €6.1 million in the first half of 2018. This marks the first operational profit for Takeaway.com since its IPO in September 2016. Management remains committed to continued investments in all markets in which it operates in order to maintain and expand strong market positions.

● Orders via Takeaway.com’s restaurant delivery service Scoober represented 4.9% of total orders in the first six months of 2019 versus 2.3% of total orders in the first half of 2018. Scoober is now active in 69 cities in ten countries and management intends to expand to more new cities in the coming period.

● Takeaway.com has been included in the AEX-Index on Euronext Amsterdam effective as of 24 June 2019.

● In May 2019, Takeaway.com Payments B.V., a 100% subsidiary of the Company, was granted a licence as a payment institution under the Dutch Financial Markets Supervision Act from the Dutch Central Bank. From 1 July 2019 onwards, all online payments in most European markets in which Takeaway.com is active will be processed by Takeaway.com Payments B.V.

Takeaway.com N.V. (AMS: TKWY), hereinafter the “Company”, or together with its group companies the “Takeaway.com”, the leading online food delivery marketplace in Continental Europe and Israel, hereby reports its financial results for the first six months of 2019.

Our people determine the success of our company and therefore we further invested in our organisation and staff to manage our growth strategy and to support the growth of our Scoober operations. Our period-end staff level increased to 4,497 FTEs as at 30 June 2019 from 2,672 FTEs as at 31 December 2018. This number included employees of the acquired businesses in Germany. Our staff number is comprised of 2,105 FTE across all markets and headquarters (2018: 1,432) and approximately 7,000 Scoober couriers, or 2,392 FTEs, as at 30 June 2019 (2018: 1,240).

The financial information included in the CFO update and financial review is derived from the condensed consolidated interim financial statements, as integrated into this document.

Condensed consolidated statement of profit or loss and other comprehensive income for the six months ended 30 June

Takeaway.com generated total gross revenue of €184.6 million in the first six months of 2019, a 68% increase from €110.2 million in the first half of 2018. This increase was the result of order growth and higher average commission rates across our markets. Including adjustment for voucher expenses under IFRS 15, revenue was €179.4 million for the first half of 2019.

Commission revenue increased to €167.1 million in the first six months of 2019, representing 91% of total gross revenue, compared with €99.2 million for the first half of 2018. The average commission rate increased to 12.5% in the first six months of 2019 from 12.3% in the first half of 2018, mainly driven by an increase of our standard commission rates in Germany and Poland from the start of 2019 and an increasing share of Scoober orders, which generally carry higher commission rates.

As a result of further adoption of online payments by consumers, revenue from online payments increased to €12.1 million in the first six months of 2019 from €7.8 million in the first half of 2018. The percentage of online paid orders increased to 62%, representing €835 million in GMV, in the first six months of 2019 from 59% in the first half of 2018.

Other revenue grew strongly by 67% in the first half of 2019, reaching €5.4 million, driven primarily by growth in placement fees to restaurants, in line with our order growth.

Cost of sales was €45.6 million in the first six months of 2019, which represented a 151% increase from €18.2 million in the first half of 2018, driven by order growth and Scoober expansion. Delivery expenses amounted to €29.5 million, representing more than half of our cost of sales. Excluding the impact of Scoober, cost of sales increased by 67% in the first half of year 2019, in line with our revenue growth.

Our gross margin declined to 75% in the first six months of 2019 compared with 83% in the first half of 2018, primarily driven by the increasing share of Scoober orders.

Staff costs were €43.4 million in the first six months of 2019, representing a 112% increase from €20.5 million in the first half of 2018. This increase was mainly driven by the acquisitions in Israel and Germany and the result of continued investments in our organisation. The staff investments are required to manage our growth strategy and we believe that continued investments in our technology and product teams are necessary to innovate more rapidly. In addition, the growth of our Scoober offering also required additional staff and management support. Note that the costs of our Scoober couriers, are not included in staff costs but are classified as cost of sales.

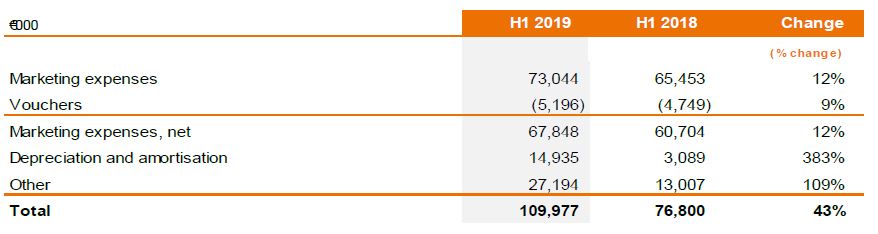

Other operating expenses comprise marketing expenses, depreciation and amortisation costs and other expenses which are mainly related to staff.

The largest component of other operating expenses is marketing expenses. Marketing expenses increased by 12% to €73.0 million in the first six months of 2019 compared with €65.5 million in the first half of 2018. This increase is relatively modest compared with our order growth, which is a clear reflection that we increasingly benefit from economies of scale in our markets. Marketing as a percentage of revenue improved in all segments during the first six months of 2019 compared with the first half of 2018.

Our depreciation and amortisation expenses were €14.9 million in the first six months of 2019, which represented a 383% increase from €3.1 million in the first half of 2018. This increase consists primarily of €8.0 million related to the amortisation of intangible assets recognised as the result of acquisitions in recent years and €3.2 million in relation to the initial application of IFRS 16 in 2019.

Other operating expenses were €27.2 million in the first six months of 2019, which represented a 109% increase from €13.0 million in the first half of 2018. This increase was mainly driven by additional staff-related expenses in line with the growth in FTEs and investments in new organisational systems, and professional fees and legal expenses related to the acquisition of the German Delivery Hero businesses.

Long-term employee incentive costs relate to the fair value expense of share-based payments for employees in a particular year. Our long-term employee incentive costs were €1.4 million in the first six months of 2019, up from €1.2 million in the first half of 2018. The main reason for this increase was the further roll-out of an Employee Share and Option Plan (ESOP) to our key senior and mid-level management.

Our finance costs increased to €7.9 million in the first six months of 2019 compared with €0.4 million in the first half of 2018, mainly due to the effective interest on the €250.0 million convertible bond we issued in January, transaction costs and interest expenses on the bridge financing of acquisitions and unrealised foreign exchange rate results of our foreign operations.

On 15 February 2019, Takeaway.com sold its interest in Takeaway.com Asia to Woowa Brothers, operators of the Korean market leader “Baedal Minjok”. In return for Takeaway.com’s part of the purchase price it acquired 0.25% in Woowa Brothers Corp. This investment is presented in the statement of financial position in the line “Equity investment”.

Income tax expense amounted to €14.5 million in the first six months of 2019 compared with €3.0 million in the first half of 2018, mostly due to the utilisation of capitalised tax losses carried forward in Germany and Poland, and the increase of the current tax expense of the non-Dutch entities of Takeaway.com.

Takeaway.com incurred a net loss of €37.4 million in the first six months of 2019 compared with a net loss of €14.7 million in the first half of 2018. The increased net loss is due to the amortisation expenses increase associated with the acquisition of the German Delivery Hero businesses and the utilisation of the deferred tax asset.

Non-current assets were €1,490.4 million as at 30 June 2019 from €291.5 million at 31 December 2018, an increase of €1,198.9 million mainly consisting of goodwill and other intangible assets as a result of the acquisition of German Delivery Hero businesses and right-of-use assets as a result of initial application IFRS 16.

Cash and cash equivalents were €59.3 million as at 30 June 2019 compared with €89.6 million at 31 December 2018, a decrease of €30.3 million. This was driven by net cash generated by financing activities of €509.8 million, offset by the net cash used by investing activities of €492.6 million driven mainly by the acquisition of German Delivery Hero businesses, and net cash used in operating activities of €47.9 million.

Shareholders’ equity increased to €1,191.0 million at 30 June 2019 from €138.8 million at 31 December 2018, following the accelerated bookbuild offering, the issuance of shares related to the acquisition of the German Delivery Hero businesses, the issuance of convertible bonds and decreased due to the allocation of the loss for the first six months of 2019 to shareholders’ equity.

Net cash used in operating activities amounted to €47.9 million in the first six months of 2019 compared with €7.0 million in the first half of 2018. The increase in net cash used in operating activities was caused primarily by payment of other liabilities including acquisition related costs.

Net cash used in investing activities was €492.6 million in the first six months of 2019, driven by the acquisition of the German Delivery Hero businesses, as well as capital expenditures made in relation to office space and IT infrastructure.

Net cash generated by financing activities was €509.8 million in the first six months of 2019, compared with nil in the first half of 2018. Net cash generated by financing activities consists of the proceeds from the accelerated bookbuild offering and from the convertible bonds, the repayment of the bridge facility related to the acquisition in Israel.

In the Netherlands, Takeaway.com processed 18.5 million orders in the first six months of 2019, representing a growth rate of 18% compared with the first half of 2018. Gross Merchandise Value (GMV) grew by 23% during the period, primarily driven by higher average order values (AOV) following the increase of the VAT rate on food in January 2019 and the growth in Scoober orders, which generally have a higher order value. Gross revenue in the Netherlands grew by 24% to €57.9 million in the first six months of 2019 compared to €46.7 million in the first half of 2018, outpacing order growth, driven by an increase in the average commission rate driven by the increased share of Scoober orders which generally carry a higher commission rate.

Adjusted EBITDA, including allocated headquarter expenses, increased to €29.0 million in the first six months of 2019 compared with €25.3 million in the first half of 2018. This resulted in an adjusted EBITDA margin of 50% in the first six months of 2019 compared with 54% in the first half of 2018.

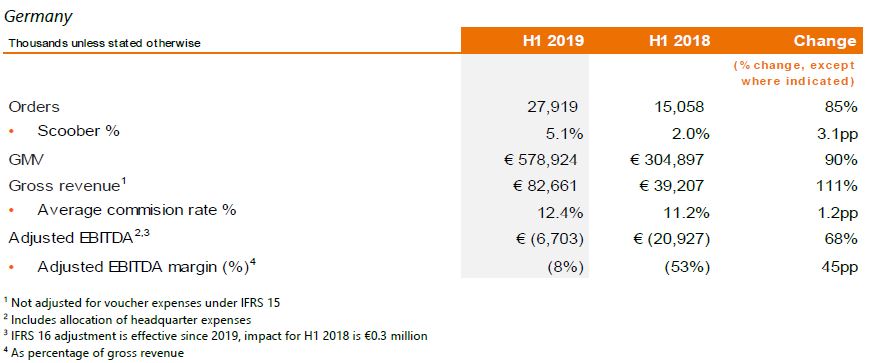

Orders processed in Germany grew by 85% to 27.9 million in the first six months of 2019 compared with the first half of 2018. Supported by the migration of the German Delivery Hero businesses, order growth accelerated in the second quarter of 2019. Average order value increased slightly year-on-year in line with the inflation rate and to a lesser extent following an increase of Scoober orders which typically have a higher basket size. Gross revenue in Germany grew to €82.7 million in the first six months of 2019 from €39.2 million in the first half of 2018, representing a 111% increase. The main reason for the higher revenue growth compared with order growth was the increased average commission rate following the standard commission rate increase from January 2019.

In Germany, the significant revenue growth resulted in scale benefits which was the primary driver of the 45- percentage point improvement in our adjusted EBITDA margin compared with the first half of 2018. Our adjusted EBITDA improved to minus €6.7 million in the first six months of 2019 compared with minus €20.9 million in the first half of 2018.

Orders processed in the Other Leading Markets segment (which includes Belgium, Poland, Austria, Israel, Switzerland, Romania, Bulgaria, Portugal, and Luxembourg) increased by 123% to 24.6 million in the first six months of 2019 compared with 11.0 million in the first half of 2018, driven primarily by the acquisition in Israel. Gross revenue in the segment grew by 82% to €44.0 million in the first six months of 2019 from €24.3 million in the first half of 2018. The difference in order growth compared with growth in GMV and gross revenue is mainly driven by Israel, where, due to the nature of the business, average order value and average commission rate are lower. Scoober orders increased to 4.9% of total orders in the first six months of 2019 compared with 2.3% of total orders in the first half of 2018, driven by our strategy to invest in Scoober for a more diverse restaurant offering to consumers.

Adjusted EBITDA deteriorated to minus €20.5 million in the first six months of 2019 compared with minus €10.5 million in the first half of 2018, driven by our investments in these underpenetrated markets in order to expand our market positions. This resulted in an adjusted EBITDA margin of minus 46% in the first six months of 2019 compared with minus 43% in the first half of 2018.

The risks outlined in the 2018 Annual Report continued to apply in the year 2019. The key operational risks we face are as follows:

● Our ability to maintain and improve our competitive position and its effect on marketing expenses;

● Our ability to keep pace with long-term developments in website and mobile applications and e-commerce relative to our competitors;

The Management Board, having responsibility for risk management with oversight from the Supervisory Board, believes that Takeaway.com's risk management framework operated effectively in the first six months of 2019. The Management Board believes that all the aforementioned risks were effectively mitigated within the boundaries of our risk appetite and is not aware of any incidents that substantially impacted the business during this period.

With reference to the statement within the meaning of Article 5:25d (2)(c) of the Financial Supervision Act, the Management Board states, to the best of its knowledge, that:

● The condensed consolidated interim financial statements as at and for the six months ended 30 June 2019 give a true and fair view of the assets, liabilities, financial position, and profit or loss of the company and the undertakings included in the consolidation taken as a whole; and