Statement of Jitse Groen, CEO of Takeaway.com: “In 2018, we have made several strategic decisions that we believe are going to prove instrumental in the future development of our company. Apart from our organic growth, we acquired four businesses to expand our footprint and gain strength in new technology. We are building on top of this growth by expanding logistical services via our Scoober offering, as well as by working hard on integrating the B2B technology developed by our new colleagues at 10bis. We are very much looking forward to 2019.”

● Takeaway.com processed 93.9 million orders in 2018, representing a 38% increase compared with 2017. Orders via Takeaway.com’s restaurant delivery service Scoober represented 3.0% of total orders in 2018 versus 1.4% of total orders in 2017.

● Gross revenue1 grew by 44% to €240.0 million in 2018 compared with €166.5 million in 2017. Excluding Israel, which has been consolidated from 26 September 2018, gross revenue grew by 42% to €236.2 million in 2018.

● In line with emerging interpretations of IFRS 15, voucher expenses have been reclassified from marketing expenses to net revenue (€7.7 million in 2018 and €3.1 million in 2017). Including adjustment for voucher expenses under IFRS 15, net revenue was €232.3 million in 2018. As vouchers continue to serve a pure marketing purpose, Takeaway.com will disclose voucher expenses separately for comparison reasons going forward.

● In 2018, the Netherlands showed gross revenue and order growth of 32% and 19% respectively compared with 2017. Adjusted EBITDA2 in the Netherlands further increased to €53.2 million in 2018 compared with €43.0 million in 2017.

● In Germany, Takeaway.com continued its strong revenue growth trajectory in 2018 with 49% gross revenue growth and 36% order growth compared with 2017. The German market represents a significant growth opportunity for Takeaway.com as it continues to tap into this large and underpenetrated addressable market. From October 2018, Germany has been Takeaway.com’s largest segment in terms of orders.

● On 21 December 2018, Takeaway.com signed an agreement to acquire the German operations of Delivery Hero for a total consideration of approximately €930 million. The transaction is subject to approval of the general meeting and is anticipated to be completed on 1 April 2019.

● Gross revenue in Other Leading Markets grew by 63% to €55.7 million in 2018 compared with €34.2 million in 2017. Order growth in Other Leading Markets accelerated to 69% in 2018 compared with 2017, primarily driven by the addition of the 10bis business that was consolidated from 26 September 2018. Excluding 10bis, full year order growth in Other Leading Markets was 40% in 2018 compared with 2017.

● Adjusted EBITDA for Takeaway.com was minus €11.3 million in 2018 compared with minus €27.6 million in 2017. This improvement was driven primarily by efficiency improvements in marketing, which offset the increased investments in our organisation and in our Scoober offering. Adjusted EBITDA margin for Takeaway.com improved to minus 5% in 2018 from minus 17% in 2017.

● In January 2019, Takeaway.com successfully raised €680 million through an accelerated book bookbuild offering of new shares and convertible bonds. The gross proceeds raised will be used to pay the cash portion of the aforementioned acquisition of the German operations from Delivery Hero and Takeaway.com fully repaid the bridge financing in connection with the 10bis acquisition.

● On 1 February 2019, Takeaway.com entered into an agreement in respect of the sale of its interest in Takeaway.com Asia (Vietnammm.com) to Woowa Brothers, operators of the Korean market leader “Baedal Minjok”. The transaction is, subject to certain conditions, expected to be completed in the course of the first quarter of 2019. Takeaway.com will acquire a shareholding of approximately 0.25% in Woowa Brothers Corp. in return for its part of the purchase price. Further financial details will not be disclosed.

Takeaway.com N.V. (AMS: TKWY), hereinafter the “Company”, or together with its group companies “Takeaway.com”, the leading online food delivery marketplace in Continental Europe and Israel, hereby reports its financial results for the full year 2018. The Company will publish its annual report 2018 on Wednesday 13 March 2019.

In view of the Company’s acquisition of the German Delivery Hero businesses and related issuances of shares, we do not provide an outlook at this point in time.

In 2018, Takeaway.com continued to invest in its organisation and staff to manage its growth strategy and to support the growth of its Scoober operations. Our year-end staff level increased to 2,672 FTEs as at 31 December 2018 from 1,171 FTEs as at 31 December 2017. This number included the acquired businesses in Switzerland, Bulgaria, Romania and Israel. The total staff can be split into 1,432 employees in FTE across all markets and headquarters (2017: 761) and approximately 4,200 Scoober couriers, or 1,240 FTEs, as at 31 December 2018 (2017: 410).

The financial information included in the CFO update and financial review is derived from the condensed consolidated financial statements, as integrated into this document.

Condensed consolidated statement of profit or loss and other comprehensive income for the year ended 31 December

Takeaway.com generated total gross revenue of €240.0 million, a 44% increase from €166.5 million in 2017, thereby exceeding GMV growth of 37%, mainly driven by higher average commission rates in each of our markets. Including adjustment for voucher expenses under IFRS 15, net revenue was €232.3 million in 2018.

Commission revenue was €217.4 million in 2018, representing 91% of total gross revenue compared with 90% in 2017. The average commission rate for Takeaway.com increased to 12.1% in 2018 from 11.4% in 2017, mainly driven by an increase in the standard commission rate in all Leading Markets from 1 January 2018.

As a result of further adoption of online payments by consumers, revenue from online payments increased to €16.0 million in 2018 from €12.0 million in 2017. The percentage of orders paid online amounted to 61% of total orders in 2018, up from 54% in 2017, representing over one billion euro in GMV.

Other revenues grew strongly by 39% in 2018, reaching €6.7 million, driven primarily by growth in placement fees to restaurants.

Cost of sales was €43.7 million in 2018, which was 62% higher than in 2017, driven by our Scoober expansion. Delivery expenses amounted to €23.8 million, representing more than half of our cost of sales. Excluding the impact of Scoober, cost of sales increased by 25% year-on-year, well below our order growth.

As a result of the above, we realised a gross margin as percentage of net revenue of 81% in 2018, down from 83% in 2017.

Staff costs were €48.5 million in 2018, representing a 51% increase compared with 2017. Excluding Israel3, staff costs grew 46%. This increase is the result of continuing investments in our organisation to execute on our growth strategy. Our investments were primarily in operational functions, where a large increase in our sales staff translated into strong growth in our restaurant offering. Over the course of 2018, our Scoober operations staff more than tripled to support our city expansion as well as the strong growth of Scoober orders. These investments do not include the 4,200 couriers, representing 1,240 FTEs, which are classified as cost of sales. Our staff, excluding couriers, increased to 1,432 FTEs as at 31 December 2018 from 761 FTEs as at 31 December 2017.

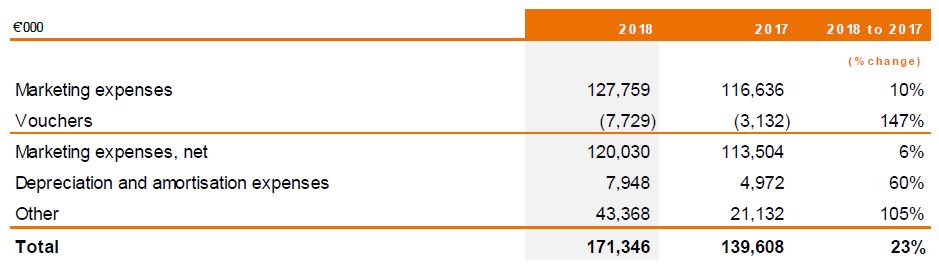

Other operating expenses comprise marketing expenses, depreciation and amortisation costs and other expenses which are mainly related to staff.

The largest component of other operating expenses is marketing expenses. Marketing expenses can be divided into performance marketing and brand awareness marketing. Performance marketing represents costs related to pay-per-click marketing such as search engine and affiliate marketing. Brand awareness marketing expenses are those which relate to investment in our brand strength through (primarily) offline channels such as television, outdoor advertising, and merchandising for restaurants. In order to retain, attract and to promote the platform, Takeaway.com distributes vouchers to existing consumers, to potential new consumers, and via partner campaigns. Voucher expenses amounted to €7.7 million in 2018 and €3.1 million in 2017.

Marketing expenses increased by 10% to €127.8 million in 2018 compared with €116.6 million in 2017, substantially lower than our order and revenue growth, reflecting the effectiveness of our marketing investments, the strength of our brand and the recurring nature of consumer behaviour. Marketing expenses as a percentage of revenue and on a per-order basis improved in all segments in 2018.

Depreciation and amortisation expenses were €7.9 million in 2018, up from €5.0 million in 2017. This related primarily to the amortisation of intangible assets recognised as the result of acquisitions, as well as depreciation on physical assets such as offices and IT related assets.

Other operating expenses were €43.4 million in 2018, an increase of 105% compared with the prior year. This increase was mainly driven by additional recruitment and other staff-related expenses to support our organisational expansion, the growth of Scoober, legal and compliance, and professional services fees. Furthermore, it contained costs related to acquisitions amounting to €11.0 million in 2018.

Long-term employee incentive costs relate to the fair value expense of share-based payments for employees in a particular year. Our long-term employee incentive costs were €2.6 million in 2018, up from €1.9 million in 2017. These expenses cover the Long-Term Incentive Plan (LTIP) for the Management Board, as well as the Employee Share and Option Plan (ESOP), which covers key senior and mid-level management.

Our finance expenses increased to €1.3 million in 2018 from €0.2 million in 2017 as a result of the execution of a €150.0 million bridge financing arrangement in connection with the 10bis acquisition.

At year-end, Takeaway.com owned 66% of Takeaway.com Asia, which in turn owns 99% of the shares and voting rights of Vietnammm.com. Takeaway.com Asia was accounted for as a joint venture using the equity method of accounting given that joint control exists in terms of decision-making. Takeaway.com’s share of loss in the joint venture was €0.2 million in 2018 compared with €0.2 million in 2017.

On 1 February 2019, Takeaway.com entered into an agreement in respect of the sale of its interest in Takeaway.com Asia (Vietnammm.com) to Woowa Brothers, operators of the Korean market leader “Baedal Minjok”. The transaction is, subject to certain conditions, expected to be completed in the course of the first quarter of 2019. Takeaway.com will acquire a shareholding of approximately 0.25% in Woowa Brothers Corp. in return for its part of the purchase price. Further financial details will not be disclosed.

Takeaway.com’s income tax benefit was €21.4 million in 2018, comprised of income tax expense of €7.7 million and recognition of a deferred tax benefit of €29.1 million. This compared with income tax expense of €4.4 million in 2017.

In the past, Takeaway.com reported losses in its non-Dutch entities and therefore accumulated tax losses in these entities which can be carried forward to offset future taxable income, if any, and if not expired in the relevant countries. In 2018, Takeaway.com implemented a new legal structure to reflect the centralised management and operating model of Takeaway.com. Subsequently the transfer pricing policy was aligned with Takeaway.com's operating model and legal structure. As a result, the Dutch entities reported a loss on a consolidated level in 2018. The non-Dutch entities reported a profit overall, which has been partly offset with the losses carried forward in those non-Dutch countries.

Takeaway.com incurred a net loss of €14.0 million in 2018, reflecting a material improvement compared with a loss of €42.0 million in 2017.

Non-current assets, mainly consisting of goodwill, other intangible assets, property and equipment, and deferred tax assets increased to €291.5 million in 2018 from €91.5 million in 2017. This increase was predominantly caused by the acquisitions in Switzerland, Bulgaria, Romania and Israel that were completed during the year.

Our cash position was relatively unchanged between the start and the end of the year, however due to the outstanding bridge facility in place at year-end, we had a net debt position of €60.3 million. Professional fees accrued at year-end in connection with the Delivery Hero Germany acquisition caused a favourable movement in working capital, and our newly-introduced transfer pricing policy also had a favourable cash impact as we were able utilise carried forward losses which were previously not recognised. As a result, net cash used in operating activities was €2.7 million (2017: €36.2 million net cash used in operating activities). Net cash used in investing activities was €147.5 million, an increase of €137.6 million on the prior year, the difference being due to our acquisition activities. Our financing cash flow amounted to €150.0 million due to the bridge facility in connection with the 10bis acquisition.

Cash and cash equivalents decreased to €89.6 million at year-end 2018 from €89.8 million at year-end 2017, representing a decrease of €0.2 million, due to the movements as described above. Of this, €11.8 million was cash held on behalf of restaurants (2017: €3.1 million).

Shareholders’ equity decreased to €137.9 million at year-end 2018 from €149.8 million at year-end 2017, following the allocation of the net loss for the year 2018 to shareholders’ equity.

Non-current liabilities increased to €27.6 million in 2018 from €6.0 million in 2017, mainly as a result of increased deferred tax liabilities, connected to our acquisitions.

Net cash used in operating activities amounted to €2.7 million in 2018 compared with €36.2 million in 2017. The change was mainly driven by our reduced operating loss.

Net cash used in investing activities was €147.5 million in 2018, mainly driven by the acquisitions in Bulgaria, Romania, Switzerland and Israel.

Net cash generated by financing activities was €150.0 million, compared with nil in 2017. We utilised a €150.0 million bridge facility in September 2018 to temporarily finance the acquisition of 10bis. This bridge facility was fully repaid with the proceeds from the capital increase in January 2019.

In the Netherlands, Takeaway.com processed 32.7 million orders in 2018, representing a growth rate of 19% compared with 2017. Gross Merchandise Value (GMV) grew by 22% during the period, driven by order growth and higher average order values. Gross revenue in the Netherlands grew by 32% to €98.3 million in 2018 from €74.4 million in 2017, outpacing order growth. This increase was driven by a higher standard commission rate from January 2018 as well as the increased share of Scoober orders.

Marketing expenses as an absolute amount only increased modestly by 6% to €13.8 million in 2018 compared with €13.1 million in 2017, resulting in a further improvement of marketing expenses as a percentage of gross revenue to 14% in 2018 compared with 18% in 2017. Adjusted EBITDA, including allocated headquarter expenses, increased to €53.2 million in 2018 compared with €43.0 million in 2017. This resulted in an adjusted EBITDA margin of 54% in 2018 compared with 58% in 2017, reflecting the increased share of Scoober orders.

Orders processed in Germany grew by 36% to 32.6 million in 2018 compared with 2017. Our order growth reaccelerated in three consecutive quarters in 2018, demonstrating our market share gains. In the fourth quarter of 2018, the Germany segment processed more orders than the website in the Netherlands. GMV grew by 39% in 2018, slightly faster than orders driven primarily by higher average order values. Gross revenue in Germany grew to €86.0 million in 2018 from €57.9 million in 2017, representing a 49% increase. The primary reason for the gross revenue growth in excess of order growth was the increased average commission rate following the standard commission rate increase from January 2018.

In Germany, our scale benefits and significant revenue growth were the primary drivers of the 38-percentage point improvement in our adjusted EBITDA margin in 2018 compared with 2017. Our adjusted EBITDA improved to minus €36.7 million in 2018 compared with minus €47.0 million in 2017.

On 21 December 2018, Takeaway.com signed an agreement to acquire the German operations of Delivery Hero for a total consideration of approximately €930 million. The transaction is subject to approval of the general meeting and anticipated to be completed on 1 April 2019.

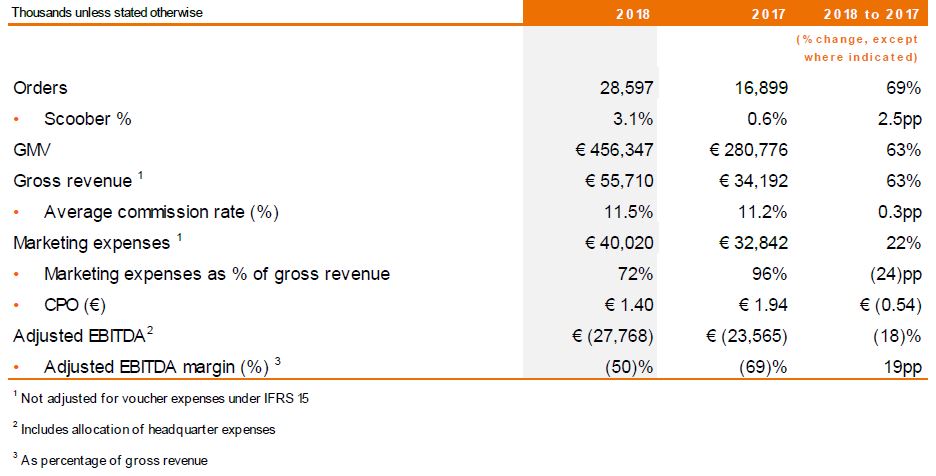

Orders processed in the Other Leading Markets segment (which includes Poland, Belgium, Austria, Israel, Switzerland, Romania, Bulgaria, Portugal, Luxembourg, and France until February 2018) increased by 69% to 28.6 million in 2018 compared with 16.9 million in 2017, driven primarily by the addition of the 10bis business as well as the high growth in Poland. 10bis has been included as part of the Other Leading Markets segment since completion on 26 September 2018 and contributed 4.9 million orders in 2018. Excluding 10bis, full year order growth in Other Leading Markets was 40% in 2018 compared with 2017. Gross revenue in the segment grew by 63% to €55.7 million in 2018 from €34.2 million in 2017.

In 2018, the average order value in the Other Leading Markets segment declined due to a mix effect reflecting a higher share of orders from markets with lower average order values, mainly in Israel, but also due to the fast growth in Poland and the acquisitions in Bulgaria and Romania. The average order value increased in each of our markets in 2018. Scoober orders increased sharply to 3.1% of total orders in 2018 compared with 0.6% of total orders in 2017, mainly reflecting the acquired businesses in Bulgaria and Romania which have a relatively large portion of Scoober orders.

Marketing expenses as a percentage of gross revenue improved to 72% in 2018 compared with 96% in 2017, mainly driven by improved CPO in Poland and Belgium. The absolute amount of marketing expenses mainly increased as a result of our expansion to new markets, such as Bulgaria, Romania and Israel, and increased focus on Switzerland in 2018. In the Other Leading Markets segment, adjusted EBITDA loss was €27.8 million in 2018 compared with €23.6 million in 2017, largely driven by our continuing investments in these high potential and underpenetrated markets. However, adjusted EBITDA as a percentage of revenue improved significantly, showing the scalable nature of our business.

In view of the Company’s acquisition of the German Delivery Hero businesses and related issuances of shares, we do not provide an outlook at this point in time.

The risks outlined in the 2017 Annual Report continued to apply in the year 2018. The key operational risks we face are as follows:

● Our ability to maintain and improve our competitive position and its effect on marketing expenses;

● Our ability to keep pace with long-term developments in website and mobile applications and e-commerce relative to our competitors;

At the end of 2017, Takeaway.com introduced an internal audit function in order to strengthen the control environment. The Management Board, having responsibility for risk management with oversight from the Supervisory Board, believes that Takeaway.com's risk management framework operated effectively in the full year 2018. The Management Board believes that all the aforementioned risks were effectively mitigated within the boundaries of our risk appetite and is not aware of any incidents that substantially impacted the business during this period.