Statement of Jitse Groen, CEO of Just Eat Takeaway.com N.V.: “Just Eat Takeaway.com is in the fortunate position to benefit from continuing tailwinds. The United Kingdom, Germany, Canada, the Netherlands, Australia, and Brazil are performing particularly strongly. Our businesses have healthy gross margins, and all our segments are adjusted EBITDA positive. On the back of the current momentum, we started an aggressive investment programme, which we believe will further strengthen our market positions. We are convinced that our order growth will remain strong for the remainder of the year.”

● The most important drivers of the network effects supporting the business model improved significantly. In the last twelve months, Just Eat Takeaway.com added a record number of new restaurants and Active Consumers. At the same time the number of Orders per Returning Active Consumer and the churn also improved, leading to a significant acceleration of top-line growth.

● Just Eat Takeaway.com processed 257 million orders2 in the first six months of 2020, representing a 32% increase compared with the first half of 2019, driven by strong accelerated order growth in the second quarter of 2020 compared with the first quarter of 2020.

● Revenue² grew by 44% to €1 billion in the first six months of 2020, compared with €715 million in the first half of 2019.

● Adjusted EBITDA² for Just Eat Takeaway.com increased by 133% to €177 million in the first six months of 2020, compared with €76 million in the first half of 2019. This strong improvement was mainly driven by gross margin growth.

● Loss for the period² was €158 million in the first six months of 2020, compared with a loss of €27 million in the first half of 2019. The loss was mainly driven by amortisation, advisory, transaction and integration related expenses connected to the combination of Just Eat and Takeaway.com and the proposed transaction with Grubhub.

● The integration with Just Eat is on track and progressing well. To benefit from global brand recognition, all of Just Eat Takeaway.com’s brands now share the same logo. Furthermore, in the first week of June, the Swiss business was successfully migrated to Just Eat Takeaway.com’s central European IT platform and other markets will follow in due course.

● Management believes the Just Eat brands, despite their current strong growth, have seen underinvestment in recent years. To strengthen, expand or recapture market-leading positions throughout our territories, we have embarked on an aggressive investment programme and will invest significantly in the United Kingdom, Canada, Australia, Italy, Spain, France and several other ex-Just Eat markets.

● In Brazil, iFood continued its strong momentum with revenue² growth of 261%3. Order growth almost doubled year-on-year, reaching just short of 200 million orders in the first six months of 2020.

● On 10 June 2020, the Company announced the proposed all-share transaction with Grubhub. It is currently expected that the Company’s shareholder circular will be published towards the end of August 2020 and the EGM will be held in October 2020. Subject to satisfaction of conditions, completion of the transaction is anticipated to occur in the first half of 2021.

Just Eat Takeaway.com N.V. (LSE: JET, AMS: TKWY), hereinafter the “Company”, or together with its group companies “Just Eat Takeaway.com”, one of the world’s largest online food delivery marketplaces, hereby reports its financial results for the first six months of 2020.

Performance highlights, aggregate of Just Eat and Takeaway.com businesses as combined from 1 January

The financial information included in the CFO update and financial review is derived from the condensed consolidated financial statements.

Condensed consolidated statement of profit or loss and other comprehensive income for the six months ended 30 June

Just Eat Takeaway.com reports a like-for-like total revenue of €1,031 million in the first six months of 2020, a 44% increase from €715 million in the first half of 2019.

Commission revenue was €875 million in the first six months of 2020, representing 85% of revenue compared with 88% in the first half of 2019. Commission revenue grew at a slower pace than GMV due to temporary commission relief measures provided to restaurants in certain markets following the coronavirus pandemic.

Other revenue includes online payment fees, delivery charges, restaurant placement fee revenue and merchandise. Vouchers and discounts amounted to €46 million in the first six months of 2020, compared with €40 million in the first half of 2019, representing a 13% increase, well below order and revenue growth. This was achieved predominantly through a lower issuance of vouchers and discounts in the United Kingdom.

Cost of sales grew by 64% in the first six months of 2020. This increase was primarily driven by continued expansion of our Delivery4 service offering. Delivery related expenses amounted to €314 million, an increase of 67% versus the first half of last year and representing 78% of our cost of sales. Although there was a significant increase in delivery expenses, delivery expenses per order decreased due to improved efficiencies. Excluding the impact of delivery expenses, cost of sales increased by 40% in the first half of 2020, roughly in line with GMV growth. These effects led to a gross margin of 61% in the first six months of 2020, compared with 66% in the first half of 2019. Excluding the impact of Delivery, the gross margin was 91%.

Staff costs were €234 million in the first six months of 2020, representing a 31% increase compared with the first half of 2019. Share-based payments costs were €18 million in the first six months of 2020 compared with €7 million in the same period of 2019. Excluding share-based payments, the staff costs were €216 million, which is an increase of 26% compared to the same period last year. Our staff related investments were primarily driven by more than doubling our delivery operations staff to support our large expansion of this offering. In addition, we continued expanding the technology and product teams, as well as increasing customer service staff to support our growth. Staff costs exclude courier wages, which are classified as cost of sales.

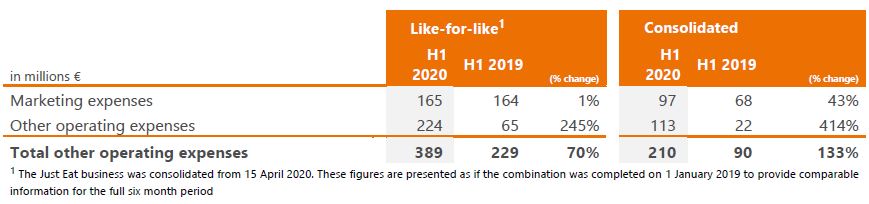

Marketing expenses increased by 1% to €165 million in the first six months of 2020, compared with €164 million in the first half of 2019. This result demonstrates the strength of our brands and the scalability of marketing costs, as consumers, orders and revenue all grew strongly, while our marketing remained flat.

In mid-March, at the start of the coronavirus lockdown measures, marketing investments were reduced due to i) uncertainty about the impact of coronavirus on consumer behaviour, and ii) lower relevance of outdoor advertising. In addition, the UEFA Euro2020 football tournament was postponed to 2021, resulting in our sponsorship costs for the tournament being deferred.

As of May, marketing investments resumed, primarily via TV and social media with the message that “restaurants are open”. In addition, we launched campaigns to support healthcare workers with free or discounted food.

Other operating expenses were €224 million in the first six months of 2020, an increase of 245% compared with the same period last year. This increase was mainly driven by €142 million of expenses due to advisory fees in connection with the Just Eat combination and proposed Grubhub transaction.

Depreciation and amortisation expenses were €85 million in the first six months of 2020, up from €35 million in the first half of 2019. This increase related primarily to amortisation of intangible assets of €34 million recognised as a result of the acquisition of Just Eat.

Our share of results of associates and joint ventures was consistent on a like-for-like basis at €31 million for the first six months of both 2020 and 2019. The losses relate to our share of losses in iFood, a Brazilian associate, of €20 million (H1 2019: €26 million) and in our Mexican joint venture of €11 million (H1 2019: €5 million). These interests were both acquired as part of the combination with Just Eat.

In the first half of 2020, we invested €50 million in both iFood (€44 million) and our Mexican joint venture (€6 million).

Net finance expense remained relatively constant at €12 million for the first six months of 2020, compared with €11 million for 2019.

Just Eat Takeaway.com’s current income tax expense amounted to €43 million in the first six months of 2020 compared with €26 million in the first half of 2019. In addition, Just Eat Takeaway.com recognised a deferred tax benefit amounting to €6 million in the first six months of 2020, compared with a €6 million deferred tax benefit in the first half of 2019. As a result, income tax expense was €37 million in the first six months of 2020, compared with €20 million like-for-like in the first half of 2019, mostly due to the utilisation of capitalised tax losses carried forward in Germany and Canada.

As a result of the factors described above, Just Eat Takeaway.com realised a net loss after tax of €158 million in the first six months of 2020.

The adjusted EBITDA attributed to segments reconciled to the net loss for the period like-for-like is as follows:

Non-current assets, mainly consisting of goodwill, other intangible assets and investments in associates and joint ventures were €9.6 billion as at 30 June 2020, up from €1.5 billion as at 31 December 2019. This increase was primarily driven by the increase in goodwill and other intangible assets related to the Just Eat acquisition. The acquisition of Just Eat has been accounted for on a provisional basis and is expected to be finalised for our full year 2020 results.

Cash and cash equivalents increased to €525 million as at 30 June 2020, from €50 million as at 31 December 2019. The balance included €33 million restricted cash held by Stichting Derdengelden Takeaway.com on behalf of third parties including restaurants, consumers and certain group entities (31 December 2019: €18 million).

Shareholders’ equity increased to €8.6 billion as at 30 June 2020, from €1.1 billion as at 31 December 2019, driven by the issuance of €7.1 billion in shares in relation to the Just Eat acquisition and the issuance of shares as part of an accelerated bookbuild offering. The allocation of total comprehensive losses to shareholders’ equity on a consolidated basis was €57 million for the first six months of 2020.

The solvency ratio, defined as total equity divided by total assets, was 83% at 30 June 2020, up from 68% at 31 December 2019, mainly driven by the increase of equity.

Non-current liabilities increased to €1.1 billion as at 30 June 2020, from €283 million as at 31 December 2019, driven by the issuance of convertible bonds amounting to €300 million and increased deferred tax liabilities arising on the Just Eat acquisition.

Net cash generated by operating activities amounted to €108 million in the first six months of 2020, compared with net cash used in operating activities of €48 million in the first half of 2019. The change was mainly driven by the positive operating results, offset by the costs associated with the Just Eat acquisition.

Net cash generated by investing activities was €35 million in the first six months of 2020, an increase of €528 million compared with the first half of 2019, which included the cash paid to acquire the German Businesses.

Net cash generated by financing activities was €333 million in the first six months of 2020, compared with €510 million in the first half of 2019. The main drivers in 2020 were (i) the issuance of new shares proceeds though an accelerated bookbuild offering of shares of €400 million, (ii) the issuance of a convertible bonds of €300 million and (iii) the repayment on our revolving credit facility (“RCF”) of €343 million.

Following the combination of Just Eat and Takeaway.com, the Company will have five operating segments: United Kingdom, Germany, Canada, Netherlands and Rest of the World, which comprises Australia, Austria, Belgium, Bulgaria, Denmark, France, Ireland, Israel, Italy, Luxembourg, New Zealand, Norway, Poland, Portugal, Romania, Spain and Switzerland. We have non-controlling interests in businesses in Brazil and Mexico. Brazil is classified as an associate for accounting purposes, while our participation in the Mexican entity is classified as a joint venture, therefore neither business is consolidated, and their results are recognised as a single line item below operating results. As the five operating segments serve only external customers, there is no inter-segment revenue.

Head office is no longer allocated to segments and will be reported separately. Head office relates to non-allocated expenses and includes all central operating expenses such as staff costs and project expenses for global support teams like legal, finance, business intelligence, human resources and board. Not included in Head office are costs of global IT and product functions, which are allocated to countries and therefore included in segment adjusted EBITDA. Previous periods for measures like adjusted EBITDA (margin) have been restated for the former Takeaway.com businesses to show comparable figures.

The Head office expense was €82 million for the first six months of 2020, compared with €48 million in the first half of 2019.

In the United Kingdom, Just Eat Takeaway.com processed 77 million orders in the first six months of 2020, representing a growth rate of 18% compared with the first half of 2019, with strong growth in both Marketplace5 and Delivery. GMV increased by 28% year-on-year, outperforming order growth by 10 percentage-points. This was driven by higher average order values during coronavirus lockdown periods. Revenue in the United Kingdom grew by 28% to €303 million in the first six months of 2020, from €236 million in the first half of 2019. To support restaurants during the coronavirus outbreak, €13 million of temporary commission relief was provided.

Gross profit increased by 22% for the first six months of 2020 against the same period last year. Gross margin declined to 73% in the first six months of 2020, from 77% in the first half of 2019, mainly caused by continuous investments in Delivery. We commenced a new partnership with McDonald’s early in 2020, as well as an exclusive partnership with Greggs, the UK’s leading bakery.

Adjusted EBITDA increased to €127 million in the first six months of 2020, compared with €87 million in the first half of 2019, an increase of 46%. Improved marketing as a percentage of revenue, driven by higher average order value and limited marketing spend resulted in an adjusted EBITDA margin of 42% in the first six months of 2020 compared with 37% in the first half of 2019.

Orders processed in Germany grew by 76% to 49 million in the first six months of 2020 compared with the first half of 2019. The increase in orders was driven by both the strong organic growth and the acquisition of the German Businesses. GMV grew by 89% in the first six months of 2020, faster than orders, driven by higher average order values following the coronavirus, which drove more families and households to use Lieferando.de.

Revenue in Germany grew to €161 million in the first six months of 2020, from €80 million in the first half of 2019, representing a 102% increase. Gross profit more than doubled year-on-year, with the gross margin remaining stable despite an increasing share of Delivery orders. This was due to (i) the introduction of delivery fees and (ii) improved efficiency of our Delivery network.

Adjusted EBITDA improved to €58 million in the first six months of 2020, compared with minus €1 million in the first half of 2019. This significant adjusted EBITDA improvement was driven by increased scale, improvements in our Delivery business and marketing synergies achieved through the integration of the German Businesses, demonstrating the scalable nature of our business and the potential of the German market.

In Canada, orders grew by 59% and reached 37 million in the first six months of 2020, compared with 23 million orders in the first half of 2019. Consistent with our other markets, higher average order values during coronavirus lockdown periods resulted in GMV growth of 67%.

Both revenue and gross profit grew by 49% in the first six months of 2020, which was 10% behind order growth. This was caused by the temporary support initiatives provided to our restaurants during the coronavirus lockdown. Excluding these initiatives, revenue and gross profit growth would have been in line with order growth for the first six months of the year.

Adjusted EBITDA increased to €29 million in the first six months of 2020, compared with €2 million in the first half of 2019. Consequently, the adjusted EBITDA margin was 13% in the first six months of 2020, compared with 1% in the first half of 2019. The improved adjusted EBITDA margin was driven by our additional scale and efficiencies in marketing and staff costs.

In the Netherlands, Just Eat Takeaway.com processed 23 million orders in the first six months of 2020, representing a growth rate of 24% compared with the first half of 2019. Driven by higher average order values, GMV grew by 36% during the period, outperforming order growth by 12 percentage-points.

Revenue in the Netherlands grew by 40% to €80 million in the first six months of 2020, from €57 million in the first half of 2019. This increase was driven by order growth of 24%, a higher share of Delivery orders and the introduction of a delivery fee for Delivery orders.

Gross margin reduced by 5 percentage-points year-on-year to 77% in the first six months of 2020, from 82% in the first half of 2019, driven by further roll-out of our Delivery network. In addition, benefits from the introduction of delivery fees were offset by higher courier cost per hour due to changes in Dutch legislation.

Adjusted EBITDA increased to €38 million in the first six months of 2020, compared with €31 million in the first half of 2019. The adjusted EBITDA margin was 48% in the first six months of 2020, compared with 54% in the corresponding period in 2019, reflecting the impact of higher share of Delivery orders.

Rest of the World comprises Australia, Austria, Belgium, Bulgaria, Denmark, France, Ireland, Israel, Italy, Luxembourg, New Zealand, Norway, Poland, Portugal, Romania, Spain and Switzerland. The Mexican business has not been consolidated as opposed to previous reports of Just Eat. The reason is that Just Eat Takeaway.com does not have a controlling interest in the company. Consequently, it has been presented as an investment in a joint venture.

Across the Rest of the World, Just Eat Takeaway.com processed 71 million orders in the six months 2020, an increase of 18% compared with the first half of 2019. GMV grew by 28% during the period, outpacing order growth, driven by higher average order values due to changes in consumer ordering habits during coronavirus lockdown.

Gross profit increased by 14% for the first half of 2020 and reached €149 million against the same period last year. Gross margin declined by 12 percentage-points compared with last year mainly driven by rapid growth of our Delivery business.

Adjusted EBITDA increased to €7 million in the first six months of 2020, compared with €5 million in the first half of 2019. This resulted in an adjusted EBITDA margin of 3% in the first six months of 2020.

On 31 January 2020, the Company’s public offer on Just Eat plc became unconditional in all respects. The initial enforcement order, which the CMA had imposed on 30 January 2020, was lifted on 15 April 2020 and on 23 April 2020 the CMA approved the Just Eat acquisition. As a result, the Just Eat business was consolidated from 15 April 2020.

On 10 June 2020, the Company announced it had entered into a definitive agreement with Grubhub for the Company to acquire 100% of the shares of Grubhub in an all-share transaction (the “Transaction”). The Transaction represents Just Eat Takeaway.com’s entry into online food delivery in the United States (“US”) and builds on the strategic rationale for its recent acquisition of Just Eat. A combined Just Eat Takeaway.com and Grubhub (the “Enlarged Group”) will become the world’s largest online food delivery company outside China measured by GMV and revenues, with strong brands connecting restaurant partners with their customers in 25 countries. The Enlarged Group will be built around four of the world’s largest profit pools in online food delivery: the US, the United Kingdom, the Netherlands and Germany, increasing the Enlarged Group’s ability to deploy capital and resources to strengthen its competitive positions in all its markets. The Enlarged Group has strong leadership positions in almost all countries in which it is present and will become a significant player in North America. Just Eat Takeaway.com owns the leading Canadian business SkipTheDishes. The Enlarged Group will be one of the few profitable players in the industry and processed approximately 593 million orders in 2019 with more than 70 million combined active consumers globally.

The Transaction is subject to the approval of the Company’s shareholders. It is currently expected that the Company will publish a shareholder circular towards the end of August 2020 and convene an extraordinary general meeting to be held in October 2020. Subject to satisfaction of conditions, completion of the Transaction is anticipated to occur in the first half of 2021.

In the second half of 2020, we will continue to focus on building the best offering for our restaurants, consumers and couriers, thereby fueling the network effects which have driven our success to date. To improve our market positions, and as announced last year, we will further invest in our Delivery network, our restaurant salesforce and marketing to optimally serve our consumers. We expect to devote considerable time and resources to a smooth and effective integration of Just Eat Takeaway.com and the preparation for the completion of the Grubhub transaction. We are excited about the opportunities that lie ahead for the company.

The risks outlined in the 2019 Annual Report continued to apply in the first six months of 2020 and are expected to apply for the remaining half of the financial year. We have however reassessed these risks and slightly rephrased the risk and/or shifted the focus. The key operational risks we face are as follows:

● Increased competition from current competitors or new entrants, impacting our ability to maintain and improve our competitive position

● Failing to adhere to internal standards on integrity and/or failing to have a common understanding of the combined group’s standard operating procedures

● Failing to exercise adequate control over joint ventures (and non-wholly owned subsidiaries and participations)

Just Eat Takeaway.com has had an internal audit function in place since the end of 2017. The Management Board, having responsibility for risk management with oversight from the Supervisory Board, believes that Just Eat Takeaway.com's risk management framework operated effectively in the first half of 2020. The Management Board believes that all the aforementioned risks were effectively mitigated within the boundaries of our risk appetite and is not aware of any incidents that substantially impacted the business during this period.

With reference to the statement within the meaning of Article 5:25d (2)(c) of the Financial Supervision Act, the Management Board states, to the best of its knowledge, that:

• The condensed consolidated interim financial statements as at and for the six months ended 30 June 2020 give a true and fair view of the assets, liabilities, financial position, and profit or loss of the company and the undertakings included in the consolidation taken as a whole;